Business vehicle depreciation calculator

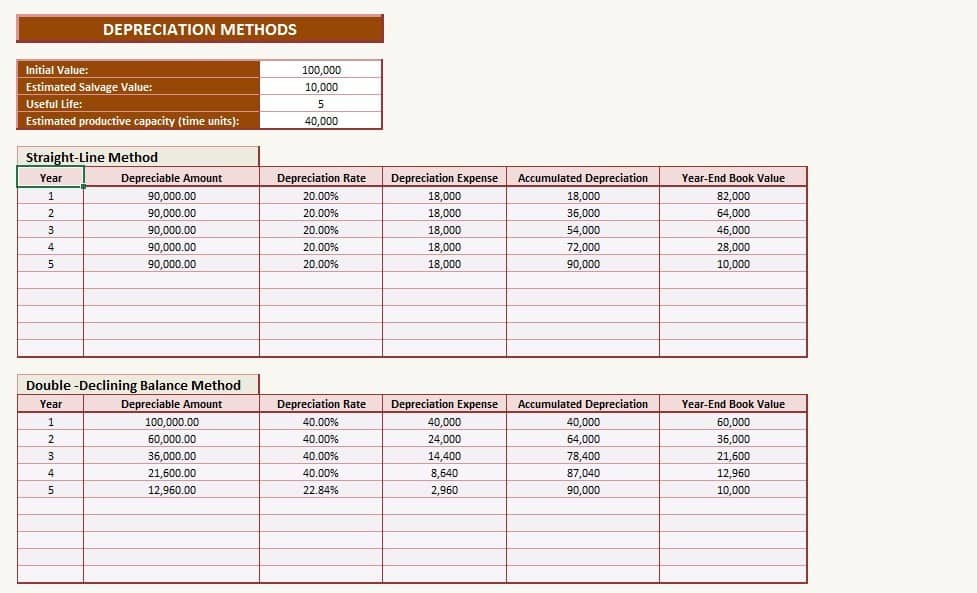

Business vehicle depreciation calculator. C is the original purchase price or basis of an asset.

Depreciation Calculator

Alternatively if you use the actual cost method you may take deductions for.

. 510 Business Use of Car. Using the Car Depreciation calculator. According to the general rule you calculate depreciation over a six-year span as follows.

Free MACRS depreciation calculator with schedules. It is fairly simple to use. Car depreciation or decline in value is the cost of the vehicle spread over its effective life.

Rental property depreciation calculator. Where Di is the depreciation in year i. Year 1 20 of the cost.

To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for. All you need to do is. Depreciation calculator companies act.

Supports Qualified property vehicle maximums 100 bonus safe harbor rules. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. D i C R i.

SUVs with a gross vehicle weight rating above 6000 lbs. You can deduct the entire 65000 in 2020 thanks to the 100 first-year bonus depreciation privilege. They are however limited to a 26200.

Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Select the currency from the drop-down list optional Enter the.

The calculator also estimates the first year and the total vehicle depreciation. Gas repairs oil insurance registration and of course. Example Calculation Using the Section 179 Calculator.

Are not subject to depreciation including bonus depreciation limits. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Years 4 and 5 1152.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Adheres to IRS Pub. The MACRS Depreciation Calculator uses the following basic formula.

Any business owner who uses a vehicle as part of their commercial operation is. If you use the vehicle only 60 for business your first-year deduction. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business.

Im dealing with a.

Depreciation Calculator Depreciation Of An Asset Car Property

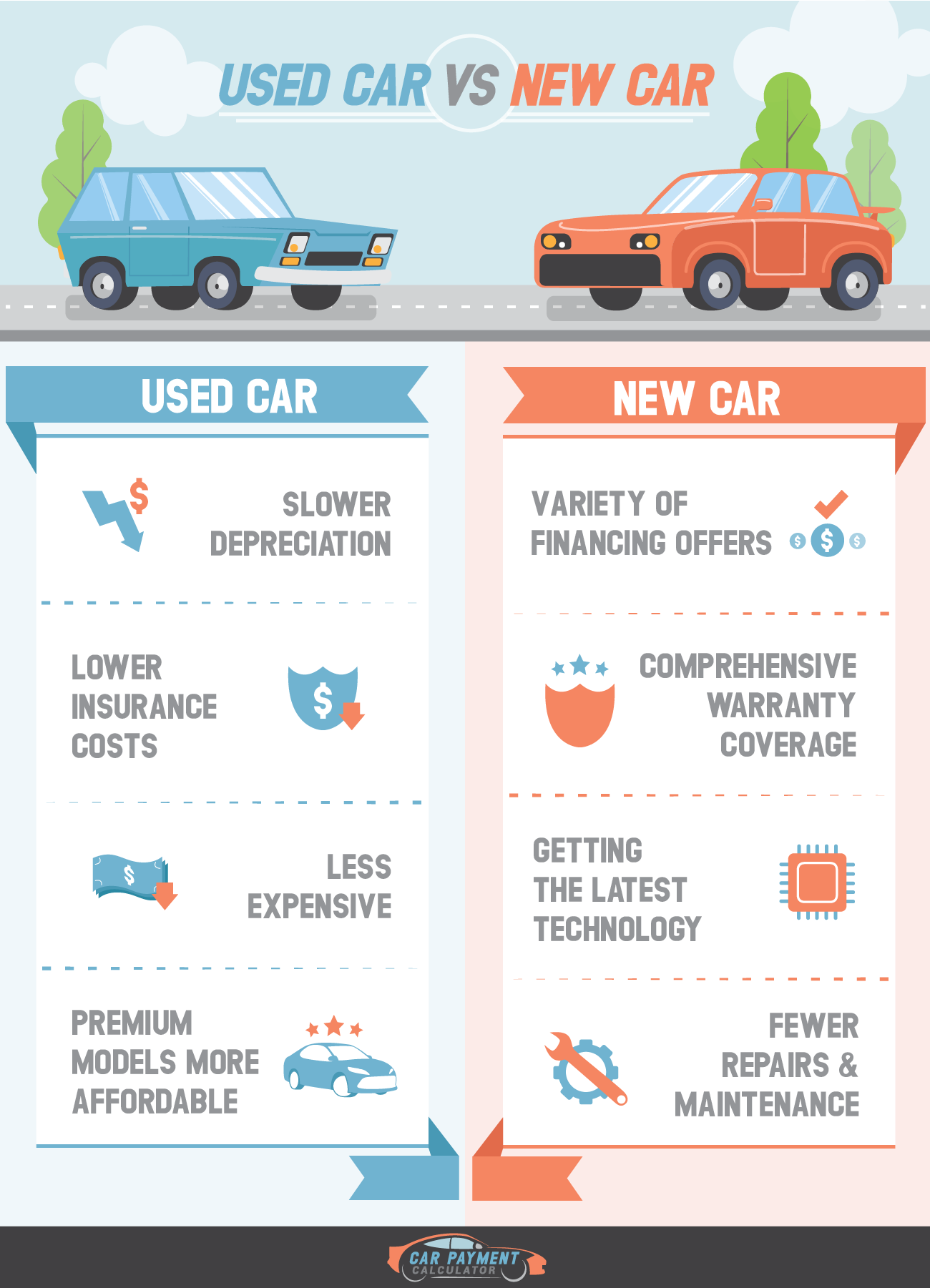

5 Logical Reasons To Buy A Used Car Visual Ly Buy Used Cars Used Car Lots Used Cars

Annual Depreciation Of A New Car Find The Future Value Youtube

Pin On Insurances

This Template Helps Prospective Business Owners Determine The Best Legal Structure For Their New Business Identi Business Structure Business Planning Business

Car Depreciation Rate And Idv Calculator Mintwise

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Car Depreciation Calculator

Pin On Car Insurance

Download Free General Ledger In Excel Format Excel Templates Accounting Smartsheet

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

Profit And Loss Income Statement Excel Business Insights Group Ag Income Statement Personal Financial Statement Statement Template

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

17 Profit Loss Statement Templates Download Free Formats In Excel Word Pdf Profit And Loss Statement Small Business Accounting Business Plan Template